Watch this important message before refinancing your mortgage. Reach out to discuss your options and know when the time is right.

Category: Home Loans

Buy Before You Sell – Helping Homebuyers Transact with Speed and Certainty

With our modern bridge solution, we can unlock equity from your current home before selling your old one and free up your debt-to-income ratio. Contact us today to get started on buying your new home!

Watch this video below to learn more!

Buy Before You Sell- Helping Homebuyers transact with speed and certainty

For more information contact us:

Chris Shumate -Loan Officer

404-791-3155 | chriss@fairwaymc.com | http://www.chrisshumatefairway.com

Elevate Your Business with Artificial Intelligence

Recording on how to use AI to elevate your business.

Best Practices

Prompting

Chat GPT X Bard

Upload Docs

Create Buyer Personas

Reach App

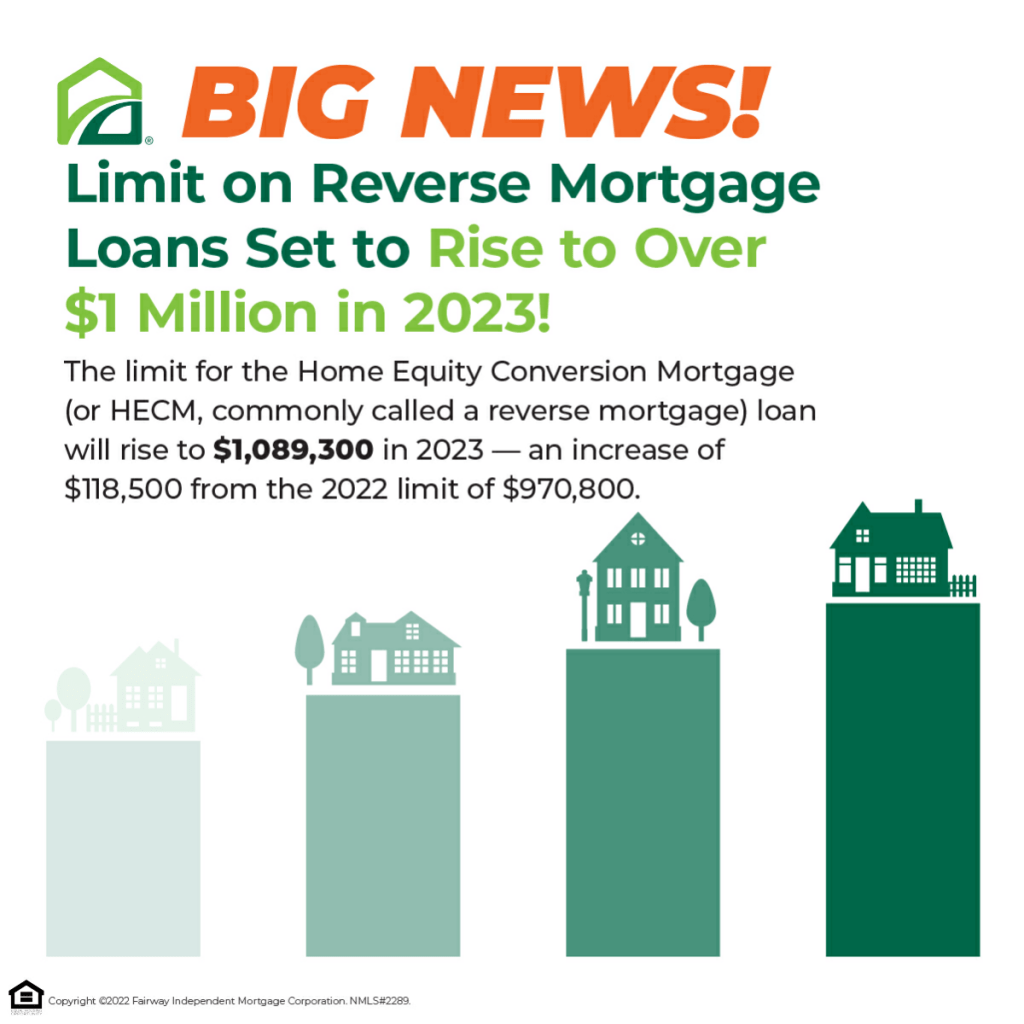

Reverse Mortgage- Best Reverse Mortgage Company 2023

A reverse mortgage is a unique type of mortgage loan for older borrowers, usually 62 or older. These loans enable you to convert a portion of your home equity into cash. Taking out a reverse mortgage can provide a lifeline for anyone on a fixed income who wants to continue living in their home but needs extra cash to pay for living expenses.

Fairway was recently named Best Overall Reverse Mortgage Company 2023. We have LOCAL Reverse Mortgage specialists on our team. Let us connect you to help explore your options.

Best Reverse Mortgage Companies 2023- click here to read more about Reverse Morgage https://www.cbsnews.com/news/best-reverse-mortgage-companies-2023/

Stop Unwanted Credit Solicitations with Opt Out Prescreen!

Trust us, it’s not us! Mortgage companies are not selling your information to other companies resulting in credit solicitation calls and text messages. This is a huge nuisance and unfortunately it is LEGAL!

Under the Fair Credit Reporting Act (FCRA), the consumer credit reporting agencies (Experian, TransUnion and Equifax) are permitted to include your name on lists used by creditors or insurers to make firm offers of credit or insurance.

The good news is you can opt out of prescreened credit offers. This means your name will no longer be included on lists that are used by creditors to send out these offers.

Here’s how you can STOP this from happening to you.

Go to optoutprescreen.com or call 1-888-5-OPT-OUT (1-888-567-8688) to opt out for five years OR permanently.

We recommend taking this step as soon as possible before applying for a mortgage as it can take a few days for credit companies to remove consumers from their prescreened offer list.

You can also help by visiting https://namb.org/call-to-action/#/24 and show your support for the current bill H.R. 2656, which would amend the Fair Credit Reporting Act to prohibit the creation and sale of trigger leads, and for other purposes. This legislation would end the dangerous practice of trigger leads which hurts consumers and damages the overall mortgage marketplace.

If you have any questions about the FTCA or credit solicitations, you can contact the FTC at 1-877-FTC-HELP (1-877-382-4357).

“Souper” Bowl

North Gwinnett Co-Op Soup Drive | Can Soup VS. Ramen Noodles

The North Gwinnett Co-Op has immediate needs to restock the shelves after the holidays. We are collecting through Super Bowl Sunday Feb 12th. Specific needs: Vegetable Soup, Cream of Chicken Soup, Canned Pasta (Spaghetti O’s, Ravioli, etc), Ramen Noodles.

Visit the Amazon wish list link and select Gift Registry address to ship directly to us and we will deliver. Donations can be dropped off at our office address below.

https://www.amazon.com/hz/wishlist/ls/1FBHNZ7XJ4TKP

Fairway Office Address: 3453 Lawrenceville-Suwanee Rd., Suite D, Suwanee, GA 30024

#togetherwemakeadifference #chrisshumatefairway #theshumateteam #northgwinnettcoop

Understanding Georgia Homestead Exemption and How It Could Help You

Have you recently purchased a home, or are you a homeowner currently occupying your home as your primary residence? If so, you will want to learn more about the homestead exemption options.

Have you recently purchased a home, or are you a homeowner currently occupying your home as your primary residence? If so, you will want to learn more about the homestead exemption options. Many homeowners may not know the exemptions, and they may not realize that they could qualify.

Below, you’ll learn more about Georgia homestead exemptions, how and where to apply, and how it could help save some money for those who qualify.

What Is the Georgia Homestead Exemption?

This type of exemption can help to reduce the amount of property taxes you owe on your legal residence. When you apply and qualify, there is a chance you could see some tax breaks on your property taxes. Saving money on your taxes is always a benefit.

Where and When Do You Need to Apply?

To apply, you will need to file in the county or city where your home is located. It’s important to keep in mind that each county will have different documents that are required and different applications to complete.

Are You Eligible

Before you can file, though, you need to be sure that you are eligible. To qualify, you need to have owned the property as of January 1 the year you want to apply. Additionally, the home needs to be considered your legal residence for all purposes. You need to occupy the home, meaning you will not qualify for an exemption if it is an investment property you are renting out to tenants.

What if you are not in the home because of health reasons? Fortunately, someone away from their home due to health issues will still be capable of getting the homestead exemption if they qualify otherwise. In those cases, a friend or a family member can contact the tax commissioner, and the exemption can be provided.

There is another thing to keep in mind regarding eligibility. You can’t already claim a homestead exemption for any other property in Georgia or another state. If you have homes in other areas of the state, you can’t try to claim it since it would mean one of those properties is not your primary residence.

Get Documentation Together

Once you are certain you are eligible, you will gather all of the documentation required by your city or county. Be sure to check with your specific county. Some of the types of documentation you will likely need to include are the property address, homeowner’s name, parcel I.D. for the property, proof of residency, and recorded deeds (at least for new owners if the county records aren’t yet up to date). Pay attention to the requirements in your location and provide everything needed.

Filing the Application

When it comes time to file, you need to file it with your county tax officials. Get in touch with them beforehand to find out how they want the application.

Here’s some good news. Once you are approved, the exemptions are typically automatically renewed each year. However, this is only true when the house is occupied by you and under the same conditions. Remember, you can’t turn it into a rental property and try to get the Georgia homestead exemption.

You need to apply by April 1 at the latest. If the application does not get into the office before then, it will not be granted until the following calendar year.

Types of Georgia Homestead Exemption

As mentioned, there are multiple types of homestead exemptions in Georgia. You will want to determine which of these you are eligible for and which one will make the most sense to you. These differ from the standard exemption discussed above. Let’s look at a few of these options below.

Exemption for People 65 and Older

If someone 65 and above’s (and their spouse’s) income was $10,000 or less in the previous year, they could claim a $4,000 exemption from all county ad valorem taxes. Income from sources of retirement funds is excluded up to the max amount paid to the individual and their spouse under the federal Social Security Act.

Disabled Veteran or Surviving Spouse Exemption

Disabled veterans can receive an exemption of $60,000 plus an additional sum determined by the index rate set by the U.S. Secretary of Veteran’s Affairs.

Surviving Spouse of U.S. Service Member

An unmarried surviving spouse of a member of the U.S. military who died as the result of armed conflict or war can be granted a homestead exemption from all ad valorem taxes for the county, as well as municipal and school purposes for $60,000 and an additional amount set by the U.S. Secretary of Veteran’s Affairs.

Surviving Spouse of Peace Officer or Firefighter

If there is an unmarried surviving spouse of a peace officer or firefighter who is killed in the course of their job, they can be granted a homestead exemption for the full value of the home for as long as they occupy the residence.

Above are some of the various types of homestead exemptions in Georgia. For the vast majority of people, though, the standard homestead exemption will be the one that is chosen. It applies to a lot of new homeowners, as well as people who have been in their homes for a while.

Get in Touch

If you think you could qualify for Georgia homestead exemption, you will want to apply. For more information visit: https://dor.georgia.gov/property-tax-homestead-exemptions. If you have any questions please contact us or visit our site.

If you are interested in knowing more about how much your home is worth, be sure to subscribe to our Homebot. It can provide you with notifications and reports each month to have better control of your wealth. https://hmbt.co/2mt7k4

Market Update-Opportunities in Housing

The opportunity you’ve been waiting for in housing is right now!

Why?

Watch this presentation with award winning expert, Barry Habib, for a in depth analysis on the mortgage and housing market.

- What’s happening in Real Estate market and why

- Where Interest Rates are headed and why

- Why NOW is the opportunity you have been waiting for in the housing market

- Addressing the negativity in the housing market

Assumable Mortgage Loans

With the recent rise in mortgage rates some buyers might be interested in an assumable mortgage loan. Here is a little bit of info regarding the FHA and VA assumption requirements/guidelines:

The FHA assumption process follows the same format as a simple assumption of a creditworthiness assumption, this is a process that would be reviewed and facilitated by the current servicer of the loan.

Two assumption programs exist for FHA mortgages:

• The Simple Assumption – for mortgage insured by the FHA before December 1, 1986

• Creditworthiness Assumption– for mortgage insured by the FHA after December 1, 1986

A simple assumption is the simpler method between the two. There is almost no legalities involved when assuming an FHA loan insured prior to December 1, 1986. Basically, you only need to inform the FHA of the buyer’s intent to assume the mortgage. No credit checks necessary.

Contrary to the leniency on FHA loans insured prior to December 1, 1986, assuming an FHA mortgage insured after the said date can be a bit more stringent. To qualify, a buyer must meet the standards set by the HUD or the Department of Housing and Urban Development. The buyer is still required to pass the qualifying requirements for a mortgage. In addition, the lender must give consent to the process by stamping his or her approval on the assumption.

The credit review shall be completed within 45 days after the lender receives all the necessary documents. The review may consist of the following requirements:

• credit review– a review of the borrower’s credit and if the current mortgage is serviced by a Direct Endorsement (DE) approved lender

• secondary financing– a secondary form of financing may be allowed, provided that the repayment terms of the loan is clearly defined and included in the underwriting analysis

• seller contributions– cash contributions from the seller for the assumption is not allowed, although they can contribute to some of the costs of closing without reducing said amount in the mortgage

With regard to VA assumptions, if a loan is transferred to another qualified VA loan beneficiary, their entitlement takes over provided a Substitution of Entitlement (SOE) is obtained. The Substitution of Entitlement also referred to as Statement of Veteran Assuming GI Loan, is a form (VA Form 26-8106) that the qualified veteran buyer signs permitting substitution of entitlement for that of the veteran-seller. Without this certification, the entitlement utilized to purchase the home will remain tied up there until the loan is fully repaid. A Substitution of Entitlement is normally possible after the borrower who had the original VA loan assumed can present a Release Of Liability form from the original VA loan.

The new buyer would have to meet all VA eligibility requirements:

• The existing loan must be current. If not, any past due amounts must be paid at or before closing.

• The buyer must qualify based on VA credit and income standards.

• The buyer must assume all mortgage obligations, including repayment to the VA if the loan goes into default.

• The original owner or new owner must pay a funding fee of 0.5 percent of the existing principal loan balance.

• A processing fee must be paid in advance, including a reasonable estimate for the cost of the credit report.

The current servicer will be able to advise if the loan is assumable and then if so, provide the required documentation needed in order to proceed.

Approval from the VA may be required as well, however, the servicer will be able to advise of such.

We hope this is helpful and if we can assist, please let us know.